But this could also be the case if you are an employee with insufficient earnings. This could be the case if you are self-employed or an independent contractor. This generally means you don’t have enough wages reported as an employee during the last 18 months to establish a regular UI claim.

#Pua portal full#

Similarly, the PUA program has a legislative end date of 12/31/20, but for most Californians the last full week of benefits will end on 12/26/20. DOL has issued guidance to clarify that, for most Californians, the last full week of benefits will end on 07/25/20. ** Under the CARES Act of 2020, the $600 additional benefits are available through 07/31/20. Last week is week ending December 26, 2020.** Up to 39 weeks (minus any weeks of regular UI and certain extended UI benefits). The effective date of your claim will begin the Sunday of the week when you last worked and became unemployed due to reasons directly related to COVID-19.

#Pua portal plus#

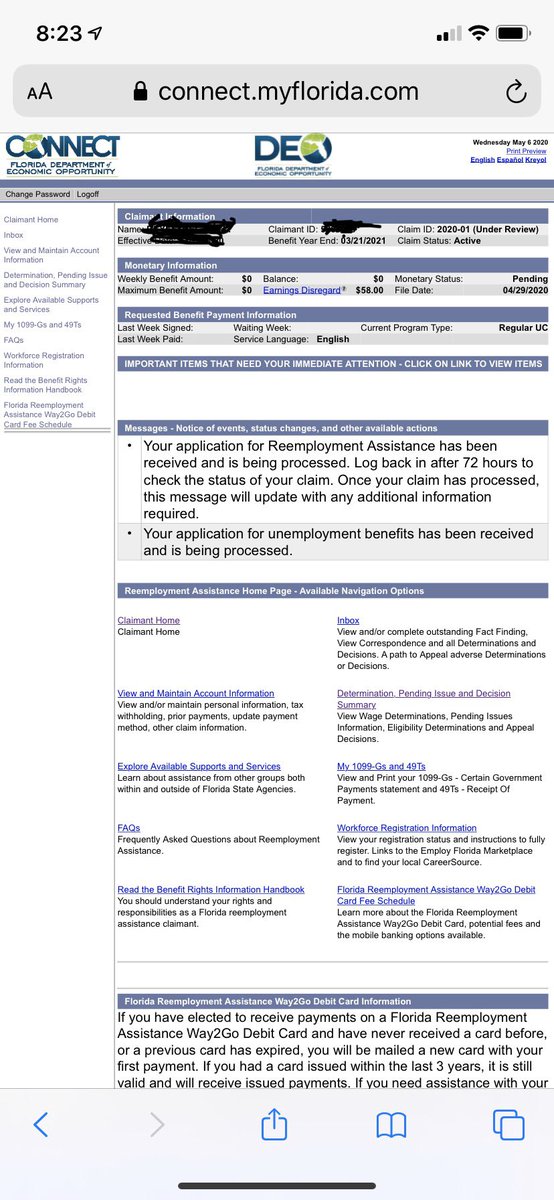

PLUS $600 for weeks between Mato July 25, 2020.**īenefits can be retroactive to weeks starting on or after February 2, 2020, depending on your last day of work due to COVID-19 and regardless of when you submitted your claim application.Minimum weekly benefit amount of $167 (but weekly amount may be higher and equal the amount provided under regular UI, depending on proof of prior earnings).Must self-certify to be able and available to work except are unemployed due to COVID-19 related reason.Individuals who have exhausted their regular and any extended UI benefits.Individuals without sufficient work history.You have a completed initial Unemployment Insurance claim on file, and you do not have an NY.GOV ID.You do not have an NY.GOV ID, and you have no previous or current Unemployment Insurance claim.Need help? Check out these short, illustrated step-by-step instructions: First name and last name: please be aware that you will not be able to change the name you enter, so please enter your correct, legal name.This is very important, because the system allows only one NY.GOV account linked to a particular email address. For example, you cannot use your husband's or wife's email address you must have your own. An email address you use regularly and one that you do not share with anyone else.To create a new NY.GOV account, you will be asked for some personal information, including: Important: If you completed an application for Unemployment Insurance on the phone with the Telephone Claims Center, please wait at least one business day before creating your NY.GOV ID. Apply for and print a 15-day Child Performer PermitĬhoose the "Create NY.GOV Account" button at the left and follow the directions.Keep your work search records in one secure place.Search for jobs through our JobZone website 24/7, and:.

Claim weekly benefits (certify for benefits) from:.Ask questions about your claim via secure messaging and.Check the status of your benefit payments.Set up or remove direct deposit to your bank account as a way to receive benefits (direct deposit cannot be set up when filing over the phone).Apply for Unemployment Insurance benefits (file a claim - your claim is processed faster when you file online) and access other online services.

0 kommentar(er)

0 kommentar(er)